Understanding discounts on the secondary market – and why they matter

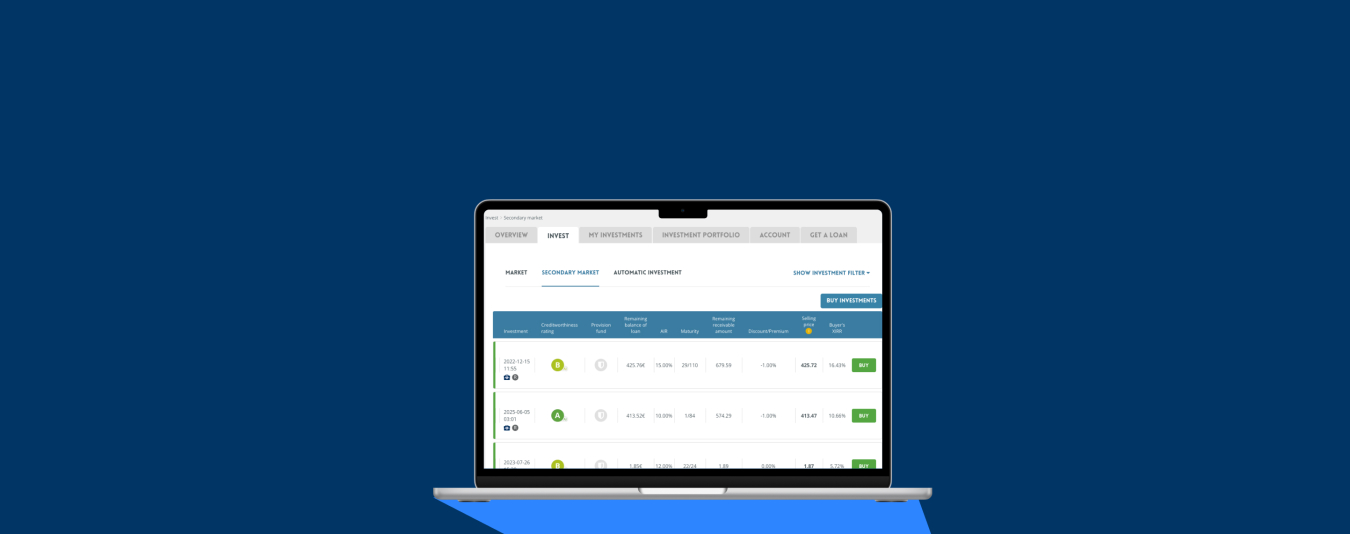

The secondary market on the NEO Finance platform inevitably appears in every investor’s field of vision – sometimes as an opportunity to sell no longer relevant investments, sometimes simply as a noisy and not fully understood alternative to the primary market on the NEO Finance platform

At first glance, everything seems simple: someone sells a loan – someone buys it. There’s a rating, a discount, a date, someone is late. But as soon as you try to answer the question “is it worth it?” – everything becomes a bit more complicated. Because for an investor who makes decisions not out of reflex, but based on analysis, the secondary market is not just a place for random transactions.

Why is it worth digging deeper if I’m not currently using the secondary market?

The secondary market is not just a place where investors sell their existing investments. It is also an open space where you can see how loan valuation forms in secondary circulation: which ratings are bought more often, which loans are selected with a discount or premium, how the supply changes depending on market conditions.

This gives the opportunity to better understand other investors’ behavior, evaluate liquidity possibilities, and observe how decisions based on different strategies work in a real environment.

Also, the secondary market can be a good alternative to the primary market, especially if you don’t find loans with your desired rating there. Since interest rates in the consumer credit market are constantly decreasing, it’s worth looking for opportunities in the secondary market to purchase older loans that had higher interest rates.

Discount, premium – what do they actually mean?

Discount

A loan with a discount is an opportunity to acquire an investment for less than its remaining value. For example, a 10% discount means that a €100 loan is offered for €90. This price difference can open the door to additional return potential, but only if all important circumstances are evaluated.

A discount in itself is neither positive nor negative – it’s a signal to take a closer look. It’s important to answer the question: what factors led to this price offer – a shorter term, temporary delay, or the investor’s desire to liquidate funds quickly?

Value is created not by the discount itself, but by what its data reveals. It’s equally important to assess the loan’s history, the borrower’s behavior, the regularity of payments, and the remaining repayment period. Only then can you decide whether the offered price matches the accepted risk.

Premium

A premium means that the loan price is higher than its remaining value. These cases usually occur when the loan has a very good credit profile – high rating, consistent payment schedule, and a short remaining term.

Buying a loan with a premium can be a reasonable decision in certain situations – for example, when seeking short-term, predictable returns, and the remaining repayment period allows for precise cash flow planning.

However, when evaluating such an offer, it’s important to calculate how much the premium reduces the final investment return. The longer the loan term and the lower the interest rate, the greater the overpayment’s impact on overall investment results.

The decision to buy with a premium should be based not on the loan’s attractiveness, but on calculation – whether the offered terms match your planned portfolio strategy.

Fees: a minor detail or a significant factor?

Both when buying and selling investments on the secondary market, a 1% brokerage fee is applied, calculated from the sale price. Although the percentage may seem small, its impact increases when evaluating short-term or low-value loans.

When calculating expected returns, it’s important to include this cost – especially in cases where the investment is purchased with a discount and quick repayment is expected. For example, with a loan that has an 8% discount and one month remaining, the fee’s impact can significantly reduce real profit.

Therefore, it’s important to evaluate not just the return percentage, but also its context – the term, the remaining value, payment history, and fixed costs.

Automatic investing on the secondary market

Automatic investing is also available on the secondary market. By creating an auto-investment listing with desired criteria (e.g., rating, term, discount), the system automatically purchases investments when they meet the set conditions. This is especially useful when aiming to react quickly to new opportunities appearing on the market.

In summary: where does value come from?

The secondary market is not an environment for impulsive decisions, but a place where value forms through understanding and analysis.

Here, you can find loans that other investors gave up on before evaluating their potential. Likewise, you may encounter offers that seem attractive at first glance, but fail to deliver real returns.

Value in this market is created not by price, but by the ability to evaluate the whole picture – from loan history to remaining term and risk profile. It’s an opportunity to improve the quality of decisions based on data, not superficial impressions.